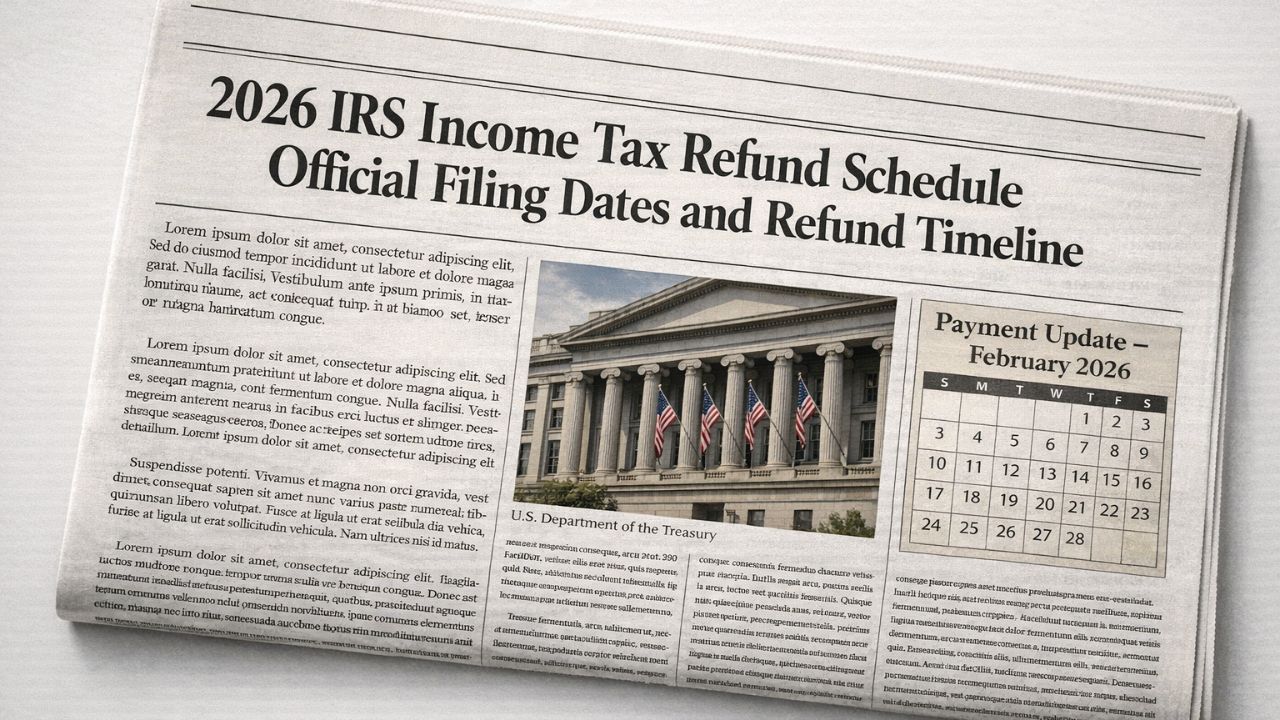

As the 2026 tax filing season continues, millions of Americans are waiting for their federal tax refunds. For many households, this money is used to pay rent, clear credit card balances, catch up on bills, or build savings. February is often the month when early filers begin to see deposits in their bank accounts. Understanding how the refund process works can help reduce anxiety and set realistic expectations.

How the Refund Process Begins

The Internal Revenue Service started accepting 2025 tax year returns in the last week of January 2026. After a return is submitted, the system first checks for basic errors or missing information. When a return is marked as accepted, it means it passed these initial checks. Acceptance does not mean the refund has been approved yet. It only means the return has entered full processing.

During processing, the IRS reviews income details, compares reported amounts with employer records, and verifies claimed credits. If no issues are found, the refund is approved and scheduled for payment.

Typical Refund Timeline

The IRS states that most refunds are issued within about 21 days after acceptance. This is a general estimate, not a guaranteed deadline. Some taxpayers receive refunds sooner, while others may wait longer depending on the complexity of their return.

Electronic filing with direct deposit is usually the fastest option. Once approved, direct deposits often reach bank accounts within one to three business days. Early filers who submitted accurate electronic returns may see refunds in early or mid-February.

Paper returns take more time. Mailed forms must be manually opened and entered into the system, which adds weeks to the process. If a paper check is requested, additional mailing time is required.

Reasons Refunds May Be Delayed

Some returns are flagged for extra review. Fraud prevention systems check for mismatched income, incorrect personal details, or unusual filing patterns. Returns claiming certain refundable tax credits may also be held until mid-February due to federal verification rules.

Identity checks can cause delays as well. If the IRS needs more information, it may send an official notice. Responding quickly can help prevent further waiting.

Tracking Your Refund

Taxpayers can check their refund status using the official IRS online tool. The system shows when a return is received, approved, and sent. After the refund is marked as sent, the final timing depends on bank processing.

The 2026 refund season follows a familiar pattern. Filing electronically, choosing direct deposit, and reviewing information carefully remain the best ways to receive funds quickly.

Disclaimer: This article is for informational purposes only and does not provide tax, legal, or financial advice. Refund timelines and processing procedures depend on individual tax situations and official IRS policies. For specific guidance, consult official IRS resources or a qualified tax professional.