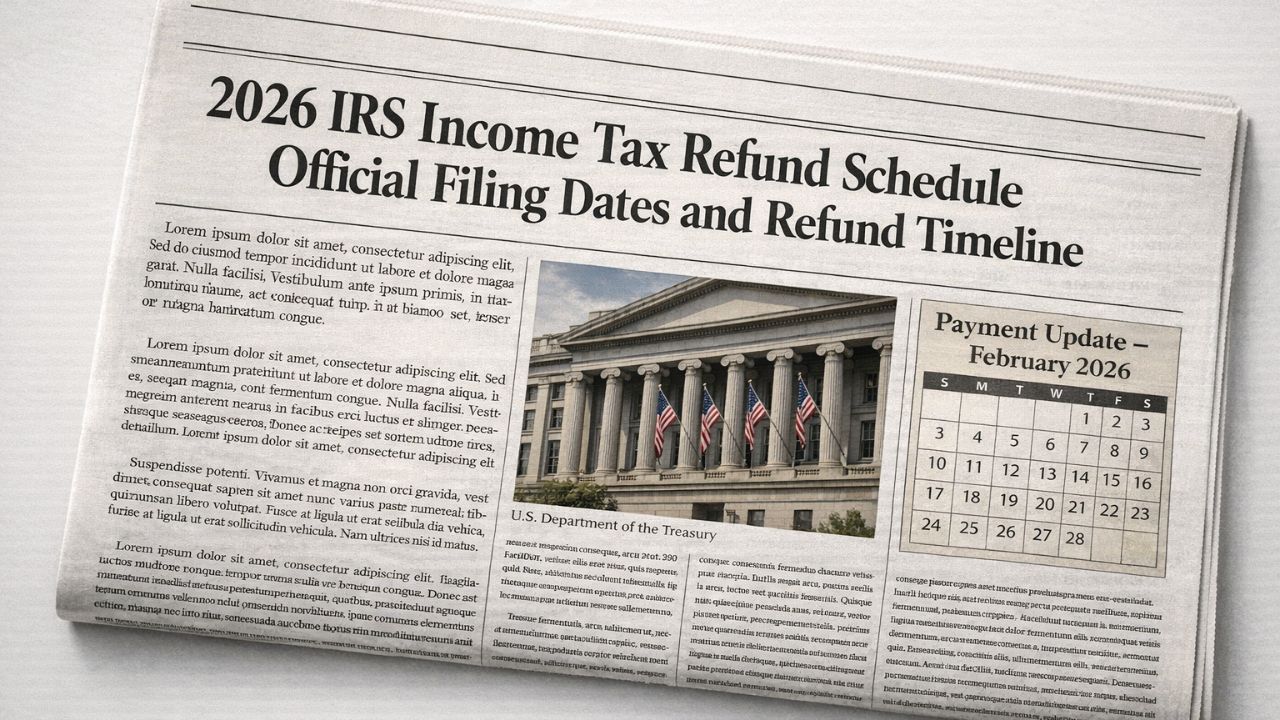

The 2026 tax season has started, and millions of Americans are getting ready to file their federal income tax returns for the 2025 tax year. For many families, a tax refund is an important part of their yearly financial plan. It may be used to cover rent, school expenses, insurance payments, medical costs, or debt from previous months. Because refunds often support essential needs, understanding how the process works can help reduce stress and confusion.

When the IRS Begins Processing Returns

The Internal Revenue Service is expected to begin accepting and processing tax returns in the final week of February 2026. Although taxpayers can prepare their returns earlier using tax software or professional services, refunds cannot be issued until the IRS officially opens its systems. The regular filing deadline is February 15, 2026. Filing close to the deadline does not increase the size of your refund and may lead to slower processing due to higher submission volumes.

Why There Is No Fixed Refund Calendar

Unlike monthly benefit programs, tax refunds do not follow a single national payment schedule. Each tax return is reviewed individually. Processing times vary based on how the return was filed, how accurate the information is, and whether extra review is needed. For this reason, the IRS does not publish exact refund dates for all taxpayers.

Fastest Way to Receive a Refund

Electronic filing combined with direct deposit remains the fastest and most reliable option. Many taxpayers who file electronically and select direct deposit receive their refund within about twenty-one days after their return is accepted. This timeframe is only an estimate and may differ depending on individual circumstances. Paper returns usually take longer because they must be manually entered into the system. Choosing to receive a mailed paper check also adds delivery time.

Common Reasons for Delays

Even early filers can experience delays. Mistakes such as incorrect Social Security numbers, missing income forms, or mismatched employer information can trigger additional review. These checks are designed to protect taxpayers from fraud. Returns that claim certain refundable credits, including income-based or child-related credits, are often reviewed more carefully, which can extend processing time.

How to Track Your Refund

Taxpayers can monitor their refund status through the official IRS online tracking tool. Updates typically appear within 24 hours after electronic filing. The system generally shows three stages: received, approved, and sent. Once marked as sent, banks may take one or two business days to post the funds.

Final Thoughts

Tax refunds play a key role in many household budgets. Filing electronically, selecting direct deposit, and reviewing all information carefully can help improve processing speed and reduce delays.

Disclaimer: This article is for informational purposes only and does not provide tax, legal, or financial advice. IRS rules, timelines, and refund amounts may change and vary based on individual circumstances. For personalized guidance, consult official Internal Revenue Service resources or a qualified tax professional.