The IRS has recently addressed growing concerns about delayed tax refunds during the 2026 filing season. Many taxpayers expected their refunds within the usual timeframe but noticed that payments were taking longer than normal. In response, the agency explained the reasons behind the delays and provided guidance on what filers should expect in the coming weeks.

Why Some Refunds Are Taking Longer

According to the IRS, most delays are connected to stronger fraud prevention and identity verification measures. As identity theft and refund fraud have increased in recent years, the agency has expanded its review process. Returns that contain inconsistencies, missing information, or claims for certain refundable credits are now examined more closely. While these additional checks may slow processing, the IRS states that they are necessary to protect taxpayers and prevent improper payments.

Paper returns are more likely to face delays because they must be handled manually before entering the processing system. Returns that trigger compliance reviews or require identity confirmation may also take extra time. Even some electronically filed returns could experience minor delays if additional verification is required.

Refunds Are Not Being Canceled

The IRS has clarified that delayed refunds are not being denied or canceled. Instead, they are being held until required reviews are completed. Once verification is finished, refunds are released. The agency has strongly advised taxpayers not to file duplicate returns while waiting, as submitting a second return can create confusion and extend processing time even further.

What Taxpayers Should Do

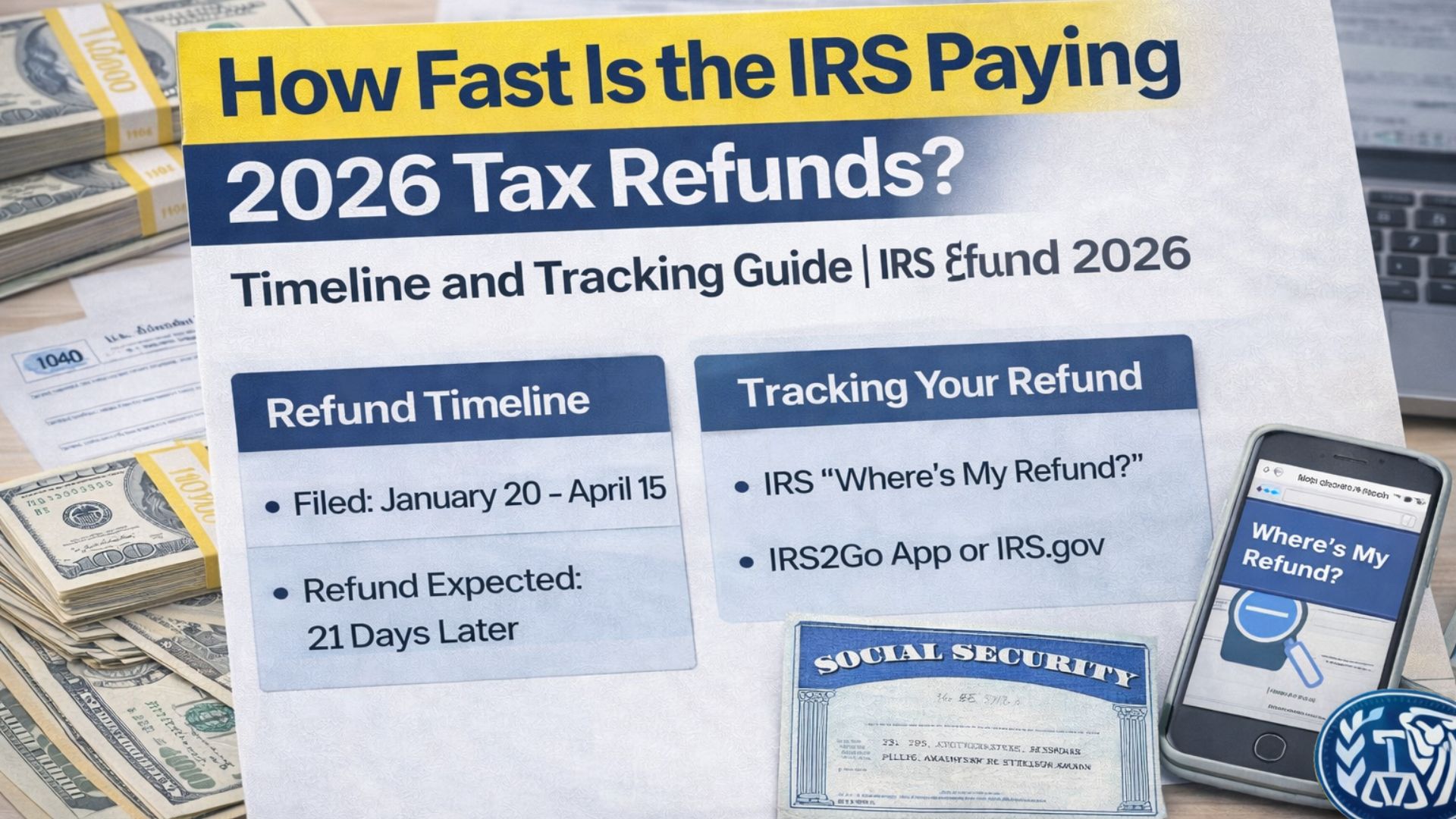

Taxpayers are encouraged to monitor their refund status using official IRS tracking tools. Ensuring that personal details, Social Security numbers, and bank account information are accurate can help prevent unnecessary delays. If the IRS requests additional documentation, responding quickly may reduce waiting time.

The agency expects refund processing to become smoother as review backlogs decrease. Most taxpayers who filed accurate electronic returns with direct deposit should still receive their refunds within standard timeframes as the season continues.

Final Thoughts

Although refund delays are frustrating, the IRS maintains that these additional checks are designed to protect taxpayers and ensure correct payments. Patience and careful monitoring through official channels remain the best approach during this period.

Disclaimer: This article is for informational purposes only and does not provide tax, legal, or financial advice. Refund timelines vary based on individual return details and official IRS processing procedures. Taxpayers should rely on official IRS communications or consult a qualified tax professional for accurate and personalized guidance.